In one word: Cycle!

If you look at successful investors, entrepreneurs in the resource sector, they mastered one thing: how to play the resource cycle.

A lot of them even build their life around their industry cycle.

What do I mean by cycle?

Generally, you can cluster companies into two spectrums, brand businesses, and commodity businesses. Commodity businesses don’t necessarily need to be associated with actual resources like e.g. Gold, Oil, Steel. You cluster them because they are dependent on an “industry price” and can not justify a higher price, because their product is mostly indistinguishable from other producers’ products.

A brand however can justify an individual price and is therefore not as dependent on the industry. This description is, of course, over-simplistic but it will help you to understand the commodity cycle.

Let’s make this more specific:

A Bitcoin Miner is a clear commodity business. It is heavily dependent on the current Bitcoin spot price. Users buying Bitcoins don’t care at all from which mining farm it comes from.

A Crypto Newsletter service is heavily dependent on the quality of content, individuals involved, brand and reputation they build. They can however justify a range of prices. This can be considered a brand business.

Now, of course, there is a spectrum in between.

From the investment perspective, brand monopolies are the assets you want to own long-term. They are superb compounders of capital.

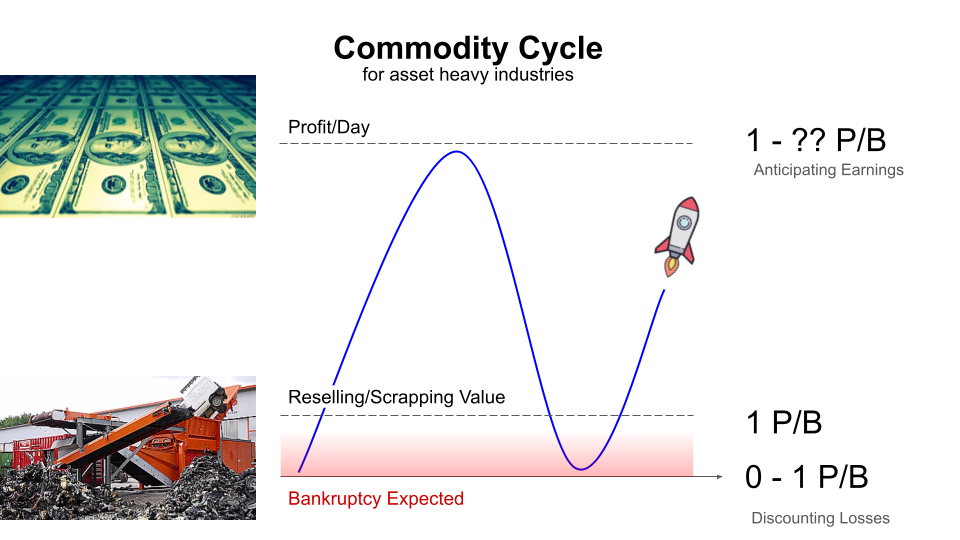

Commodity businesses are always subject to price changes for their commodity. This results in burning cash, dilution of shareholders in times when the commodity price is below production cost. On the other hand, once commodity price rises significantly above all-in-sustaining costs, these companies produce high cashflows and often initiate special dividends or buybacks.

Generally, you don’t want to own these assets long-term. However, if you happened to invest in the time of a rising resource price, they are often outperforming brand businesses because their multiples go from “pricing for bankruptcy” to “pricing in daily cashflow”.

So, what’s a commodity cycle?

Historically speaking the commodity cycle is a repeating pattern of a general price increase in energy (e.g. crude oil), industrial metals, precious metals as well as agriculture.

The bull markets for commodities in 1970-75, 1985-90 and 2000-2008 all have been times of high consumer price inflation as well as generally weak for growth equities.

Playing the cycle

Most successful commodity entrepreneurs started their company long into a bear market, waiting for the recovery to set in.

In resources, you are either a contrarian or you are going to be a victim

Rick Rule

Contrarian meaning, they entered the market in years that had the highest bankruptcies. I think in one interview Ross Beaty, a successful mining entrepreneur, joked about: the best time to enter a cyclical industry is when sector ETFs get delisted. For him, this is a contrarian sign that no investor interest is left.

This seems quite straightforward, why wouldn’t anybody do that?

Truth is, that it is hard to raise money in a sector that has been in a bear market for 10-15 years. It’s much easier to do it in times when the same sector equities are trading at all-time high multiples.

How does this apply to Web3.0?

As I already described in Bitcoin Cycles & Narrative Change the halving periods of Bitcoin induced a high price performance over the following 12 – 18 months.

Now, granted, bear markets in crypto have not taken longer than 2-3 years. Not 10-15 years like in physical commodities.

Learning for cyclical markets:

- Try to be a contrarian and research projects & teams especially in bear markets

- Enter the market during maximum negative press

- Exit at least in partial tranches during euphoria