RiskRatchet

I just coined that term

This is a pattern I recognized from reading books of successful investors as well as reviewing quite a lot of market data. However, I have not found anyone naming this recurring pattern.

Risk Classes

Within any given theme, be it

- Gold

- Bitcoin / DLT

- Tech

- Cannabis

there is always a spectrum of risk classes to choose from when deciding to play a theme. Let’s take the example of Gold:

| Risk Class | Example |

| Physical Gold | XAUUSD |

| Gold Royalty & Streaming | Franco Nevada |

| Producer / M&A (Large Tier) | Barrick Gold |

| Producer (Small, MidTier) | B2Gold |

| Development Company | Equinox Gold |

| Exploration Company | too many 😉 |

You can simply buy gold if your thesis is that it will perform well over the next years. However, buying a Gold Royalty & Streaming Stock will offer a better return because of their operational leverage to the gold price. And so the different risk classes continue. The highest leverage within a Gold Bull Market is actually achieved by buying companies that have not yet build a mine but are currently exploring to find gold. That leverage, however, works in both ways: If gold does not perform as well the exploration company might be insolvent while you could still be holding your ounces of physical gold.

Shifting Risk Classes

The interesting point is during a bull market investors’ confidence rises and they are more open to shift their position to a higher risk class. Utilizing this shift can help to increase your overall returns as well as risk and volatility adjusted returns.

The Gold Bull Market from 1999 – 2011 could have been played best by buying

- Physical Gold for the first few years

- Shifting to Producers and Developers

- And finally allocating funds to warrants of exploration Companies for the last few years

RiskRatchet in Crypto

The same applies to Web3.0 Assets. Currently, Bitcoin is still the dominant asset. Ethereum closely follows, but during a bull market like 2017 most altcoins outperform. Asymmetric but irrational returns happen at the peak of the bull run in the highest risk class of “ICO”s or future equivalents.

RiskRatchet

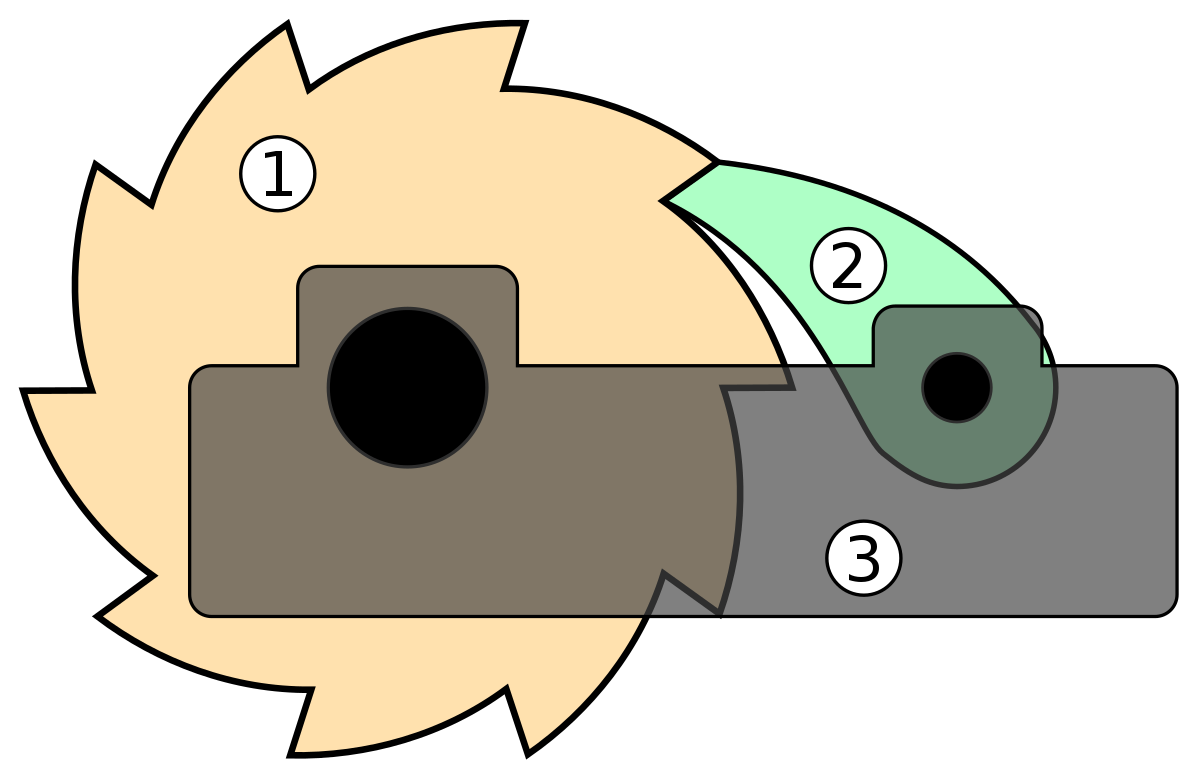

I started to refer to this phenomenon as “RiskRatchet”, because just like with a hardware ratchet, once the market shifts to the next risk class it gets adopted as “the new thing” and cannot move back. Of course, once the peak is reached the whole process reverses at double the speed. Just like once you release the tension of the ratchet.