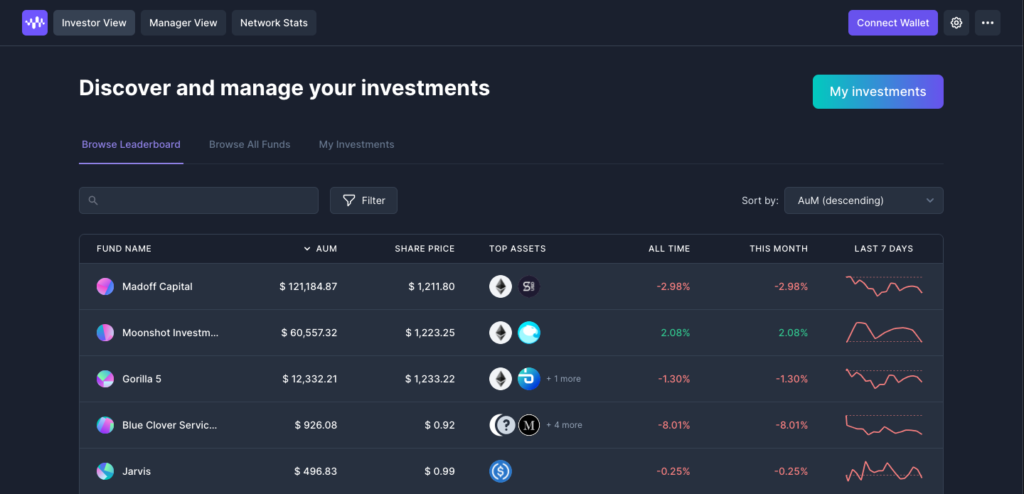

Over the last few days, I had the chance to test version 2 of the Melon project, which was recently rebranded as Enzyme.

I’ve outlined my basic investment thesis for it before here: Melon: A turnaround crypto project from the last cycle

Not only have they executed their goals and user feedback from 2020, but they broadened their vision even further. Let’s go through the improvements step by step.

What did they change?

Firstly, and most importantly they are increasing the asset universe!

“Your fund will be capable of holding and trading any ERC-20 token for which there is a reliable price oracle.”

Enzyme – Asset Whitelisting Policy

This is a huge step up from the previous version, which was limited to 17 fixed tokens. How much performance can a fund get out of a basket of 17 major tokens after all? Why should you choose one fund over another, or even pay the management or performance fee at all, instead of investing in the same tokens yourself?

However, in a world of thousands of tokens, most of which smallcap, and with hard to understand investment cases, would you pay somebody for deep research and outperformance over bitcoin? I know I would.

So, if the team can reliably launch this feature to the public “mainnet” version, I would already call that a major success for the project.

What other improvements are there?

- Funds can be opened at no upfront costs (perfect for adoption)

- New recurring fee structure based on AUM (aligns incentives long-term)

- Discount on fees for managers holding MLN

- Whole UX/UI make-over (fund can be set up in under 10mins)

Most of these had been suggested by Tom Shaughnessy of Delphi Research in MIP7. I consider the involvement of Delphi and even Real Vision in Enzyme as essential, as these have exactly the audience Enzyme needs to onboard new fund managers and increase total AUM for the protocol.

One more thing..

Steve Jobs announced break-through innovations always with: but there is “one more thing”. Just like that, the Enzyme team quietly implemented a game-changing new feature into the current version.

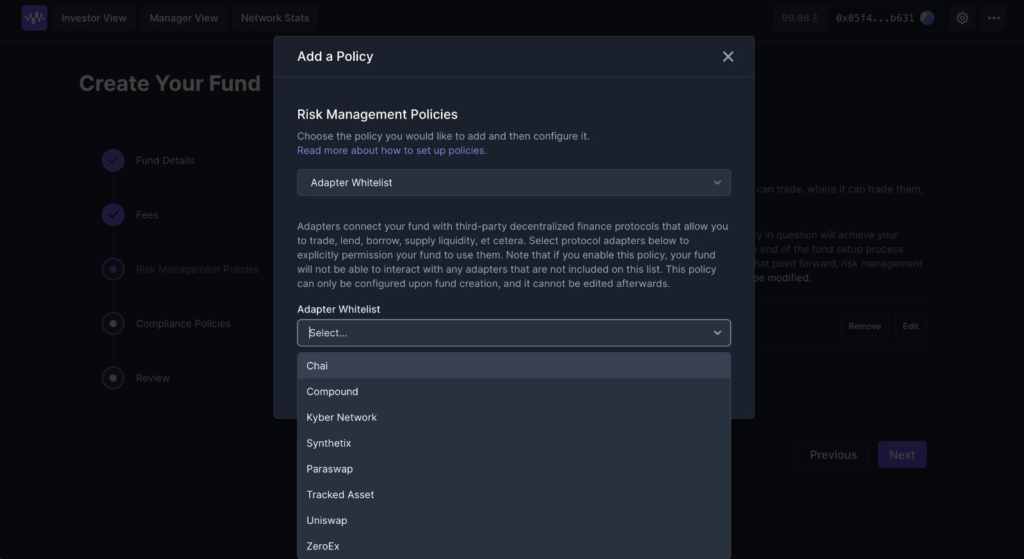

Apparently, you will now be able to add “adapters” into your fund.

The UI describes an “adapter” as any third-party decentralized finance protocol. Synthetix is already listed.

This would allow you to include any real-world asset that Synthetix lists into your Enzyme fund. You could add GLD, SLV, or Crude Oil (currently on Synthetix) and have all the accounting and performance calculations done on-chain.

Of course, we are still in the early stages with version 2, but I think the market is not pricing in anything close to the potential I’m seeing here.

Disclaimer: I hold MLN Tokens.