There are not many projects that can be categorized as a direct infrastructure for DeFi. There are even fewer projects where you can say that while they are not even fully launched.

However, The Graph is one of these unique exceptions. As I outlined in Simple Web3.0 Bets it pays-off to have core positions in projects with very few assumptions. This protocol is the best example of one.

Protocol & Ecosystem

What does The Graph exactly do? They provide a decentralized querying layer for DeFi applications, Smart Contracts, or any other analytics dashboard.

Most interfaces for applications you already know like Aave, Synthetix, and Uniswap are powered by an early – still centralized – version of The Graph. The main objective of The Graph, however, is to decentralize this essential layer of the Web3.0 Stack.

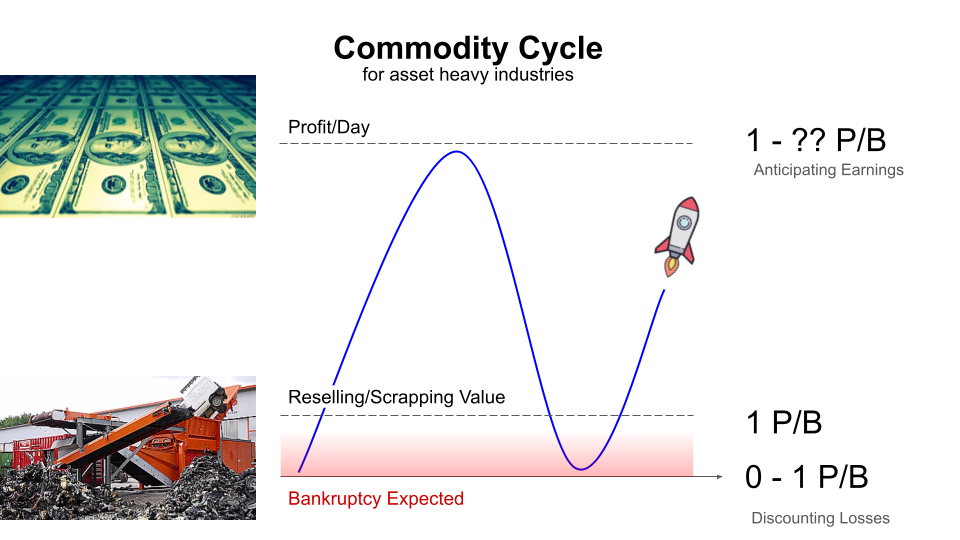

The decentralized ecosystem will consist of a few types of stakeholders:

- Users: Applications wanting to query Blockchain data

- Indexers: Node operator answering queries for specific subgraphs

- Subgraphs: On-Chain data collections

- Curators: People allocating GRT to a subgraph

- Delegator: People delegating to an indexer

For a direct glimpse into the team and development of The Graph, I encourage you to read this article by Kyle Samani from Multicoin.

Update: for a faster intro to The Graph check out this awesome video

Participate

As the protocol transitions to a more decentralized ecosystem the role of the curator will be especially interesting for everyone reading this. I myself will be signing up as a curator.

Summary

The Graph is currently the most promising contender in the race for indexing middleware with existing product/market fit. It represents an essential layer of the Web3.0 Stack and thus an essential part of my portfolio.

Links for your own research

The Graph Discord

https://thegraph.com/

https://everest.link/

I encourage you to look into the Curator role of The Graph:

The Graph Curator Program: Blog Post

Sign up for Curator Role here.

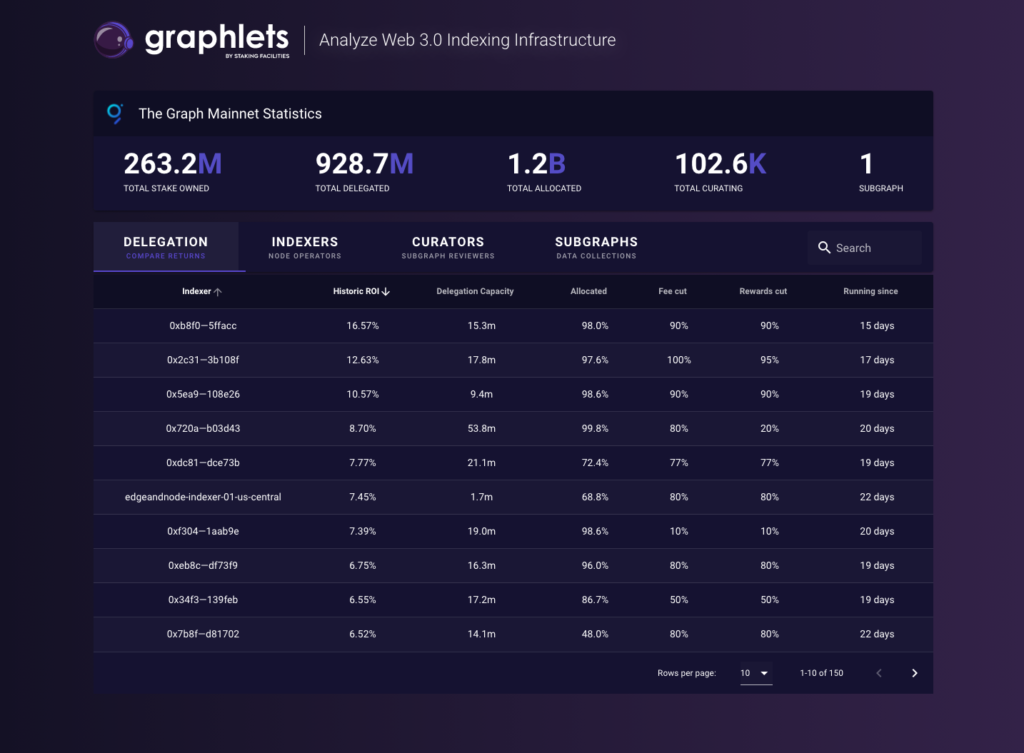

Update: The Graph Mainnet launched in December 2020. Feel free to check-out graphlets for live metrics of The Graph Mainnet: https://graphlets.io/

Disclaimer: I personally hold positions in GRT Token.