Covid-19 affected many people and lifes healthwise. This post, however, will only look at the effect it had on markets.

As I outlined in the post How I entered the crypto rabbit hole I originally wanted to research how to protect against or even profit during a bear market.

Next to this leading me into gold, resources, and crypto I still wanted to understand how to effectively hedge against a decline in the broad stock markets.

Ways to hedge

Once you tackle the finance jargon and try to understand the mechanics of all of the different financial instruments the options seem as following:

- Shorting Companies or Index

- Buying Put Options on Equity Index

- Buying a 1x or 2x inverse ETF

- Buying Inverse Leverage Certificates

- VIX Futures or Calls on VIX Index

- Buying Credit Default Swaps (not available to retail investors)

All of them have different advantages and disadvantages, but all of them are correlated to the equity index going down. They can work well if you want to hedge for minor correction but to successfully hedge a recession, it would also require you to sell on the exact bottom. Furthermore, if your thesis takes longer than you though your returns get diluted over time.

With Central Banks’ involvement in December 2018, it made sense to me in late 2019 that buying put options was not the highest quality trade to do.

Luckily, through one of the many channels I’m following I found the solution I was searching for since 2016.

Feel free to check out other sites I’m following closely: Resources

Hedging through Interest Rates

Real Visions, Raoul Pal explained a way to hedge against a recession by betting on lower interest rates. So you are essentially betting not on a recession itself but on the counteraction of Central Banks in case one happens.

The true miracle in that is, the counter to your thesis is not a rising stock market but rising interest rates. And the last thing any Central Bank wants to do in a recession: is raising interest rates. This allows you to exit this trade over a period of time and not need to catch the exact bottom of the index. Truly helpful as one can see currently.

One would now think: ok, but how much money is there to be made if interest rates go from 1.75% to 0. Well, turns out the EuroDollar Interest Rate Market is one of the most liquid in the world, offering a variety of options to leverage that move even years into the future.

You can see the charts I created for myself in Q3 2019 to research this trade. As you can see the average drop in interest rates during the last recessions was about 5,5%. With US ISM PMI being a leading indicator. So, it’s not a far stretch to assume that interest rates will be cut to 0 in the next recession.

the average period of rate-cutting to the bottom of the cycle was about 18 months with cuts ranging from 25 – 75 bps.

However, the market was still pricing in a 0% Chance of Interest Rates falling to 0 by December 2020.

This Trade was described in detail on Real Visions Private Member Platform.

Interestingly, RealVision posted this very sophisticated trade idea free on YouTube a few months after it was visible on their membership site.

Trade Execution

This is the performance of GE Dez 2020 Call 99 at the beginning of March 2020.

It performed from 0,035 to 0,72 and you can still sell it now for around 0,70. Try selling your index puts for the price they traded at the end of march now. This trade not only offered significant returns in a time when everything went down, but it also did that with exceptionally low volatility.

Learnings

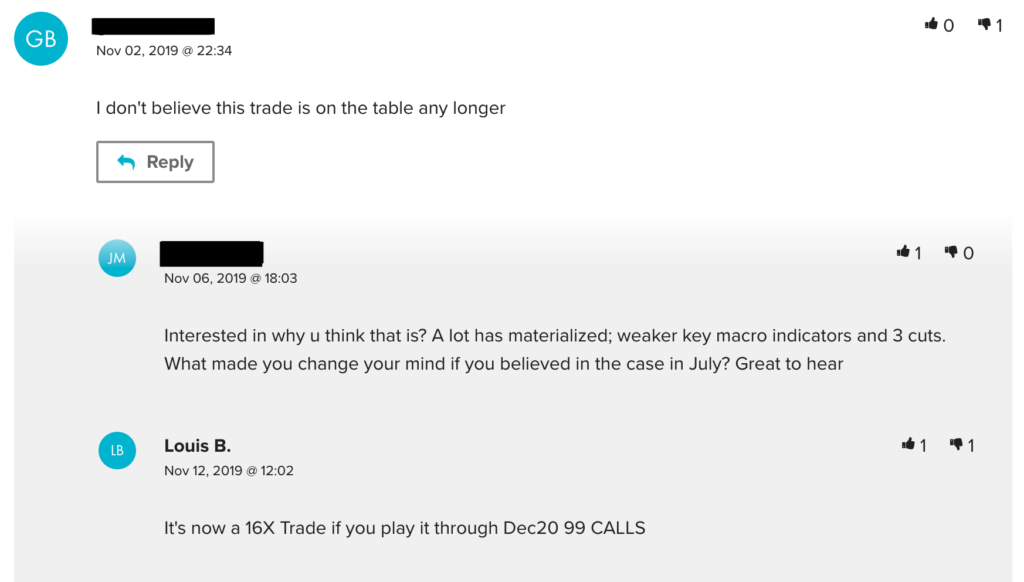

This looks like a once in decade trade for anyone who was aware of it. However, for many, it was actually not that easy to follow through. For people that got too excited, were too leveraged, or didn’t plan in a margin of safety in terms of their option expiration it was hard to follow through. Furthermore, scaling into a position if you are already down -50% to -70% is mentally tough.

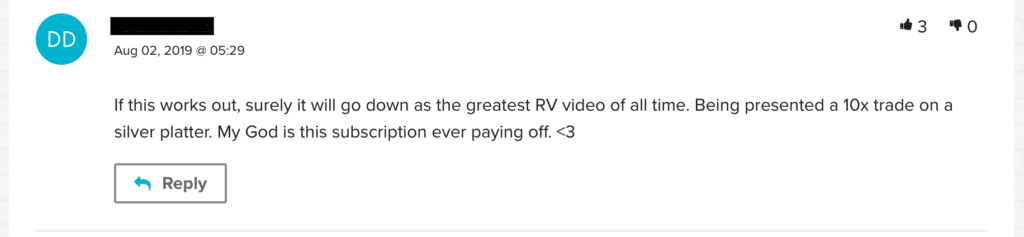

From the dates of the comments, you can see the enthusiasm change within the RealVision Community

I’m compiling this post mostly for myself to document how difficult it actually is to have an opinion that is currently not consensus, analyze it rationally, plan the structure and time horizon, then execute, and finally sticking to it.

But if the asymmetry justifies it, one should consider even a low probability bet. This trade was special because it offered exceptional asymmetry IN ADDITION to being a great exit trade in times of illiquidity. This means you have the chance to sell these options and have the chance to buy in a market almost everyone is selling their holdings or covering their margin call.

Will this trade be repeatable? the same trade worked already in 2000 and 2008, however, now that we are near zero in the US it is unclear if we get a chance for another one. Maybe in other countries, but structuring the same trade will be hard in other currency markets.